The competition in the weight-loss drug market has intensified as Novo Nordisk (NVO) made a bold move by cutting the price of its blockbuster obesity treatment, Wegovy, by more than half. The Danish pharmaceutical giant launched an online pharmacy, NovoCare Pharmacy, offering the weight-loss drug for $499 per month, a dramatic reduction from the previous list price of $1,349 for a 28-day supply. The price cut comes at a critical time as Novo Nordisk faces stiff competition from pharmaceutical compounder Hims & Hers Health (HIMS) and other industry players.

NovoCare Pharmacy: A Game Changer in Direct-to-Consumer Sales

With the launch of NovoCare Pharmacy, Novo Nordisk has entered the direct-to-consumer pharmaceutical market, ensuring that cash-paying patients and those without insurance coverage for weight-loss drugs can access Wegovy at a significantly lower price. This move aligns with the company’s commitment to providing authentic, FDA-approved semaglutide, reducing the risks associated with compounded versions.

Novo Nordisk emphasized safety concerns in its official announcement, stating, “NovoCare Pharmacy offers reliable access to authentic, FDA-approved Wegovy in our once-weekly, single-dose pen.” The company aims to address growing concerns over counterfeit or illegitimate compounded semaglutide versions being sold online by various vendors.

Hims & Hers Faces Challenges as FDA Ends Semaglutide Shortage

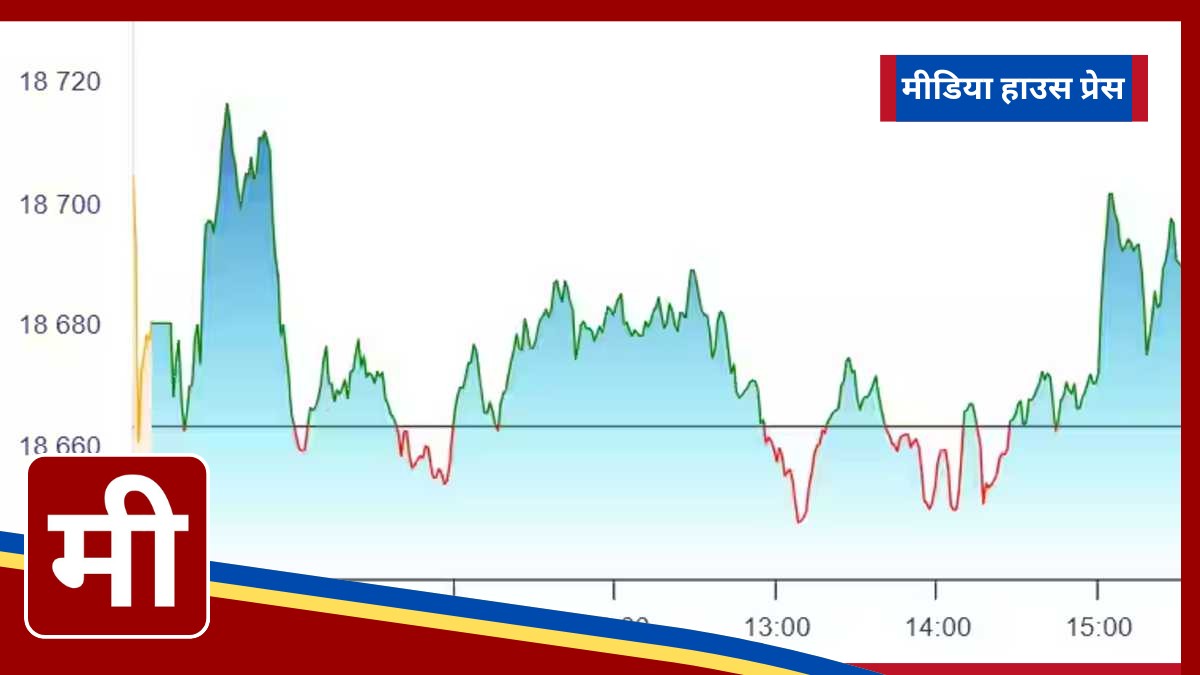

The price cut dealt a blow to Hims & Hers Health (HIMS), a company that has profited from offering lower-cost compounded semaglutide doses. Hims stock tumbled 3.7% to 38.98 following the announcement. The Food and Drug Administration (FDA) recently declared that semaglutide is no longer in shortage, meaning that Hims & Hers and other compounders will soon be required to stop selling lower-cost versions of Novo’s dosages.

Hims & Hers has responded by shifting its focus toward personalized semaglutide doses, hoping to retain customers who prefer customized weight-loss solutions. However, with Novo Nordisk’s aggressive pricing strategy, it remains to be seen how much market share Hims & Hers can maintain.

Novo Nordisk Stock Surges Amid Price Cut

Investors responded positively to the price cut and the launch of NovoCare Pharmacy. Novo Nordisk’s stock jumped more than 90.72 in morning trades, reflecting market confidence in the company’s strategy. Conversely, Hims & Hers stock slipped more than 2% to 39.48 as investors weighed the impact of the FDA’s decision and Novo Nordisk’s direct pricing strategy.

Novo Nordisk Follows Eli Lilly’s Lead in the Weight-Loss Drug War

Novo Nordisk’s aggressive move mirrors the strategy of its main rival, Eli Lilly (LLY), which last year launched its own direct-to-consumer platform, LillyDirect. The platform sells treatments for obesity, diabetes, and migraines, and has positioned Lilly as a dominant player in the obesity drug market.

Novo Nordisk now claims it has the capacity to meet or exceed both current and projected U.S. demand for Wegovy, a crucial factor as demand for weight-loss drugs continues to skyrocket. By ensuring a steady supply and slashing prices, Novo Nordisk is attempting to cement its position as the leader in the booming weight-loss drug industry.

Obesity Drug Market Poised for Explosive Growth

The weight-loss drug market is experiencing unprecedented growth. According to MarketsandMarkets, the obesity treatments market was valued at $37.4 billion in 2023 and has grown to $47.4 billion in 2024. Projections indicate that by 2032, the market will expand nearly tenfold to a staggering $471.1 billion.

Novo Nordisk and Eli Lilly are expected to be the dominant players, but they are not alone. Several other pharmaceutical companies are developing obesity treatments to compete in this lucrative space. Analysts forecast that by 2030, Wegovy will generate nearly $23 billion in sales, while Lilly’s Zepbound is expected to bring in $22.7 billion.

Upcoming Competition in the Weight-Loss Market

While Novo Nordisk and Eli Lilly currently dominate, emerging players like Viking Therapeutics (VKTX) and Amgen (AMGN) are set to challenge their market share in the coming years.

- Viking Therapeutics (VKTX) is expected to see its first sales from its obesity drug in 2028, generating $241.1 million. Analysts predict revenue will rise to $704.2 million in 2029 and $1.35 billion in 2030.

- Amgen (AMGN) is developing an obesity drug named MariTide, which is expected to bring in $43.3 million in 2028, before skyrocketing to $999 million in 2029 and $2.47 billion in 2030.

What’s Next in the Battle for Obesity Drug Supremacy?

With the price cut on Wegovy, Novo Nordisk has sent a clear message to competitors: it is ready to dominate the weight-loss drug market with aggressive pricing and direct consumer access. As more pharmaceutical companies enter the obesity treatment space, consumers can expect increased competition, more pricing adjustments, and innovative new products.