Market Sentiment Shifts Amid Intel Struggles: A Look at Stock Rebounds and Challenges

Stock markets saw a resurgence of positive sentiment today, as major indices like the S&P 500 and Dow Jones rebounded nearly 5% from recent losses. However, not all stocks participated in this rally. Intel (INTC), the tech giant that has been under pressure for much of the year, continued its steep decline. The company’s shares plummeted almost 20% as acquisition hopes evaporated, and broader policy uncertainty around the semiconductor industry intensified.

In this article, we will examine the key factors driving Intel’s stock performance, the broader market’s recovery, and the ongoing challenges that could shape future investment sentiment. We’ll also explore the implications of recent policy changes and market reactions to key events impacting the tech sector.

Intel’s Steep Decline: The End of Acquisition Hopes?

Intel stock experienced significant momentum last month, with its shares surging by $8 to $27.55, fueled by speculation that Taiwan Semiconductor Manufacturing Co. (TSMC) might be considering an acquisition of the company. These rumors had investors excited about the possibility of a major strategic partnership, which could have redefined Intel’s future.

However, as the speculative buzz surrounding the potential acquisition began to fade, investor sentiment shifted dramatically. The stock’s bullish trend reversed sharply, leading to a significant sell-off. In the last week, Intel shares dropped by nearly 20%, hitting lows not seen in recent months.

TSMC’s $100 Billion Investment: A Disappointment for Intel Investors

This week, the downward momentum for Intel accelerated further when TSMC—one of Intel’s largest competitors in the semiconductor industry—announced a $100 billion investment in U.S. chip production. However, the announcement made no mention of any plans to acquire Intel, a detail that investors had been hoping for. The lack of news on the potential acquisition front left many disappointed and fueled a new wave of selling pressure on Intel stock.

TSMC’s investment in U.S. chip production marks a significant step toward expanding its footprint in the American market, but the absence of Intel in the announcement signaled that any acquisition hopes were, in fact, fading. As a result, Intel’s stock price continued to plummet, eventually dipping nearly 5% to $20.20 before experiencing a modest recovery.

The Ongoing Struggles: Intel’s Market Position and Future Outlook

Intel’s struggles are not just limited to acquisition rumors or investor sentiment. The company is facing increased challenges in the semiconductor market, particularly with its competition against TSMC and other industry players like AMD. Despite Intel’s strong historical position in chip manufacturing, its competitors have gained ground in both process technology and market share, creating a challenging environment for Intel moving forward.

Additionally, Intel’s struggles are exacerbated by policy uncertainty. The semiconductor industry is highly reliant on government support and favorable policies, especially in countries like the U.S. where national security concerns and economic competitiveness play a significant role in government funding decisions.

The Trump Factor: Pressure on the CHIPS Act

Intel’s difficulties deepened after former President Donald Trump called for the repeal of the CHIPS Act, a key piece of legislation designed to incentivize investment in U.S. semiconductor manufacturing. Trump criticized the government’s direct funding approach for semiconductor companies, arguing that businesses like Apple and TSMC have committed to substantial investments in U.S. chip production without relying on government subsidies. This criticism of the CHIPS Act added another layer of uncertainty to Intel’s future, particularly as it is one of the largest beneficiaries of the program.

Repealing the CHIPS Act: What It Means for Intel

The CHIPS Act was designed to provide financial support to semiconductor manufacturers in the U.S., with the goal of boosting domestic production capabilities and reducing reliance on foreign suppliers. Intel, as one of the leading U.S.-based chipmakers, has been a significant recipient of funding from the CHIPS Act.

The proposal to repeal the CHIPS Act raises questions about Intel’s ability to secure future capital and support for its manufacturing initiatives. The loss of government subsidies could severely impact Intel’s ability to compete with companies like TSMC, which have strong international backing. For investors, this uncertainty over capital access further erodes confidence in Intel’s future performance, leading to increased selling pressure and a continued decline in stock value.

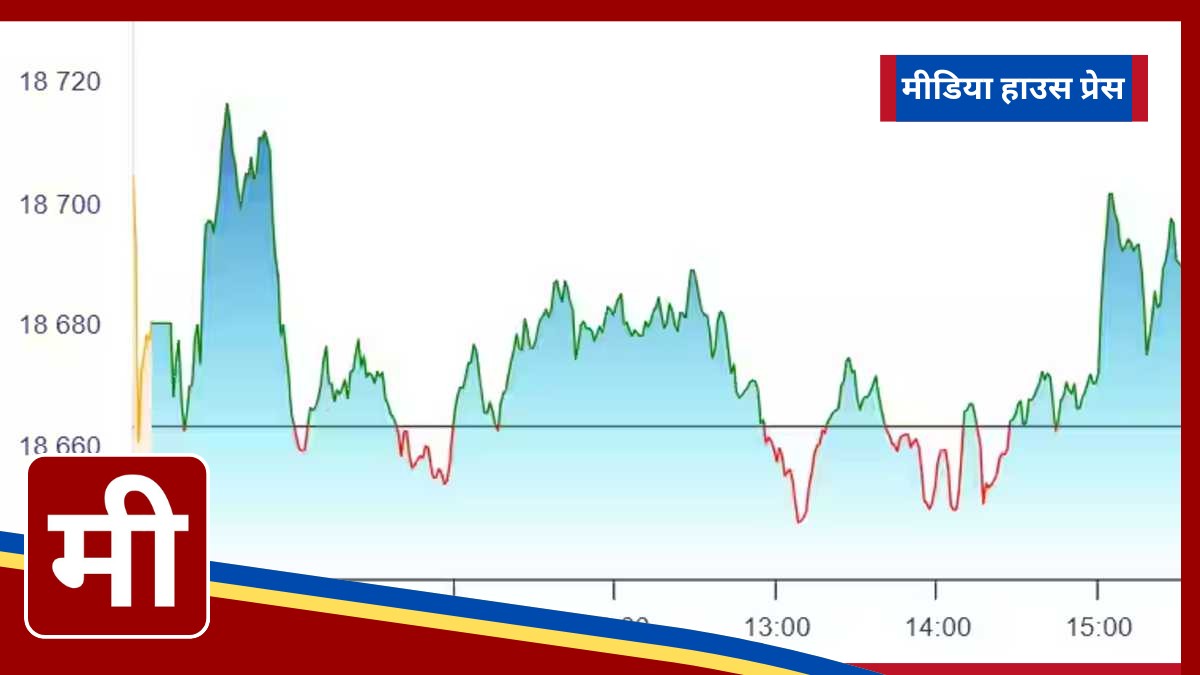

Broader Market Recovery: Dow Jones Rebounds

While Intel’s struggles have been a major point of concern for tech investors, the broader market found some relief today. The Dow Jones Industrial Average, which had been under heavy pressure due to escalating tariffs on imports from China, Canada, and Mexico, saw a notable rebound. The index, which had lost over 4% in the past two days, climbed 1.5% in today’s session, regaining some ground from recent losses.

Tariff Exemption Hopes Boost Market Sentiment

The rebound in the Dow Jones can be attributed to signs that the White House may be open to discussing additional tariff exemptions. Following a period of intense trade tension, particularly with China, the possibility of tariff adjustments or exemptions provided a glimmer of hope for market participants. Investors, who had been concerned about the economic fallout from continued trade wars, began to reassess their positions in light of these new developments.

Dow Jones and Nasdaq Recovery: A Fresh Outlook for Risk Appetite

As trade tensions eased, risk sentiment improved, benefiting broader market indices like the Dow Jones and Nasdaq. The Nasdaq, in particular, showed signs of a potential turnaround after experiencing a significant decline over the past few weeks.

In fact, the Nasdaq Composite found technical support at the 20,060-point level, preventing further downside. A doji candlestick formation on the daily chart signaled a potential bullish reversal, and with today’s 1.5% recovery, the tech-heavy index is showing signs of strength. This recovery may signal a broader market rebound, with investors once again focusing on growth sectors like technology, especially as companies continue to benefit from trends like digital transformation and AI adoption.

Nasdaq: Technical Indicators and Support Levels

The Nasdaq had been on a downward trajectory after hitting a peak of nearly 22,200 in February. The recent 10% decline, triggered by a combination of economic concerns and tech sector weakness, left the index vulnerable to further sell-offs. However, key technical indicators suggest that a bullish reversal could be underway.