US stock markets experienced sharp volatility on Tuesday after President Donald Trump followed through on his promise to impose heavy tariffs on Canada and Mexico. The move triggered immediate threats of retaliation from both trading partners, increasing fears of a global trade war and raising concerns that the world economy could head toward a downturn similar to the Great Depression of the 1930s.

Market Reaction: Whipsaw Trading and Heavy Sell-Offs

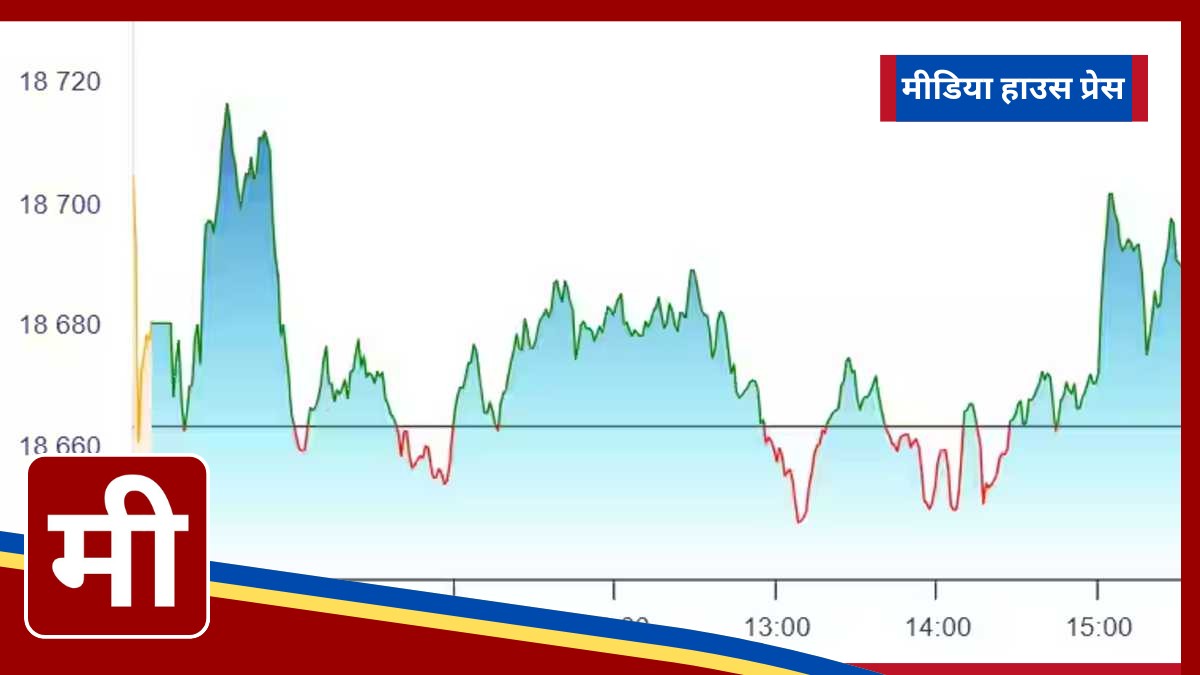

The Dow Jones Industrial Average, which initially plummeted 800 points in the morning, staged a brief recovery before closing with a 670-point loss, equivalent to a 1.55% decline at 42,521. The broader S&P 500 fell 1.22%, and the tech-heavy Nasdaq Composite dropped 0.35% after briefly entering correction territory earlier in the session.

The fact that we’ve had a pretty big and speedy bounce is yet another sign that, for many active traders, the mindset is ‘buy dips, said Steve Sosnick, chief strategist at Interactive Brokers.

Meanwhile, the VIX, commonly referred to as Wall Street’s “fear gauge,” surged to its highest level this year as volatility gripped the markets. The S&P 500 fell below its 125-day moving average, signaling heightened investor uncertainty, according to CNN’s Fear and Greed Index.

Global Market Fallout

Trump’s decision to implement tariffs sent shockwaves through international markets. European markets suffered significant losses, with the STOXX Europe 600 index falling 2.14% and Germany’s DAX tumbling 3.54%. In Asia, Japan’s Nikkei 225 fell 1.2%, while Hong Kong’s Hang Seng index slid 0.28%.

“The market finally took the Trump administration at its word, and the realization that the tariff talk wasn’t just a negotiating tactic is starting to sink in,” said Chris Zaccarelli, chief investment officer for Northlight Asset Management.

Currency Market Impact and Safe Haven Rally

The US dollar fell to its lowest level since December as investors weighed short-term uncertainty and the potential for economic slowdown. Mexico’s peso depreciated slightly, while the Canadian dollar saw a modest gain.

Gold futures surged, reflecting increased geopolitical and economic concerns. Investors typically flock to gold as a safe haven during periods of market turbulence.

Retaliatory Tariffs from Canada and Mexico

Trump latest tariff action imposed a 25% levy on goods imported from Canada and Mexico, along with an additional 10% tariff on Chinese goods, bringing China’s overall rate to 20%. The White House stated that these measures were aimed at curbing the flow of fentanyl into the United States.

However, the economic repercussions could be severe. Inflation-weary American consumers, already struggling with rising prices and a slowing job market, may see further strain on household budgets. Consumer confidence has declined, layoffs are rising, and inflation remains above the Federal Reserve’s 2% target.

China swiftly retaliated, announcing tariffs on key US agricultural imports, including chicken, pork, and beef. Canada also vowed to hit back.

Canadian Prime Minister Justin Trudeau strongly condemned the tariffs in a press conference, stating that Canada “will not back down from a fight.” He announced immediate 25% tariffs on US goods worth C$30 billion ($20.7 billion), with additional tariffs of C$125 billion ($86.2 billion) to follow within three weeks.

“This is a very dumb thing to do,” Trudeau said, directing his comments at Trump. “There is absolutely no justification or need whatsoever for these tariffs today.”

Mexico’s President Claudia Sheinbaum echoed Trudeau’s sentiment. She confirmed that Mexico would announce retaliatory tariffs on US imports by Sunday, emphasizing that Trump’s decision negatively impacts both foreign and domestic companies operating within Mexico.

“The unilateral decision made by the United States affects national and foreign companies operating in our country, as well as our people,” Sheinbaum said.

Wall Street Adjusts Expectations Amid Uncertainty

The stock market selloff accelerated as investors grew increasingly convinced that Trump’s tariff threats were not mere negotiation tactics but rather a hardline policy stance. Monday’s trading session had already seen significant losses, with the Dow closing down 650 points and the S&P 500 experiencing its worst day since December. The Nasdaq Composite briefly dipped into correction territory.

“While Tuesday’s tariffs are a go, it remains very unclear on just how long these tariffs will remain,” wrote Clark Geranen, chief market strategist at CalBay Investments. “We tend to believe these are more of a negotiation tactic and not the start of a long and drawn-out reciprocal trade war. Still, in these situations, investors sell first and ask questions later, as seen during Monday’s selloff.”

George Smith, portfolio strategist for LPL Financial, pointed out that despite the significant one-day declines, US stocks had recently reached record highs. He suggested that historical trends show that buying during market dips has often proven to be a profitable strategy over time.

“While every situation is different, historically, buying the dip after such single-day declines has been a successful strategy on average,” Smith said.

Trump Address to Congress and Economic Outlook

Trump is set to deliver his first address to Congress in his second term later on Tuesday. The speech, themed “Renewal of the American Dream,” comes at a time when stock market gains since his reelection have been entirely wiped out. Additionally, the Federal Reserve Bank of Atlanta’s real-time GDP forecast projects a potential economic contraction of 2.8%.

As global trade tensions escalate and economic uncertainty looms, investors, businesses, and policymakers will closely watch how Trump’s administration navigates the complex dynamics of international commerce. The long-term ramifications of this trade standoff remain to be seen, but for now, Wall Street is feeling the brunt of the turmoil.