A Look at Financial Performance

In the first half of 2024, Ford’s traditional business, known as Ford Blue, generated an earnings before interest and taxes (EBIT) of $2 billion. In contrast, its commercial division, Ford Pro, produced more than double that amount with an impressive $5.6 billion in EBIT. Notably, Ford Blue’s EBIT margin stood at 4.3%, while Ford Pro boasted a significantly higher margin of 15.9%. This disparity highlights the potential financial benefits that digital services can bring to automotive operations.

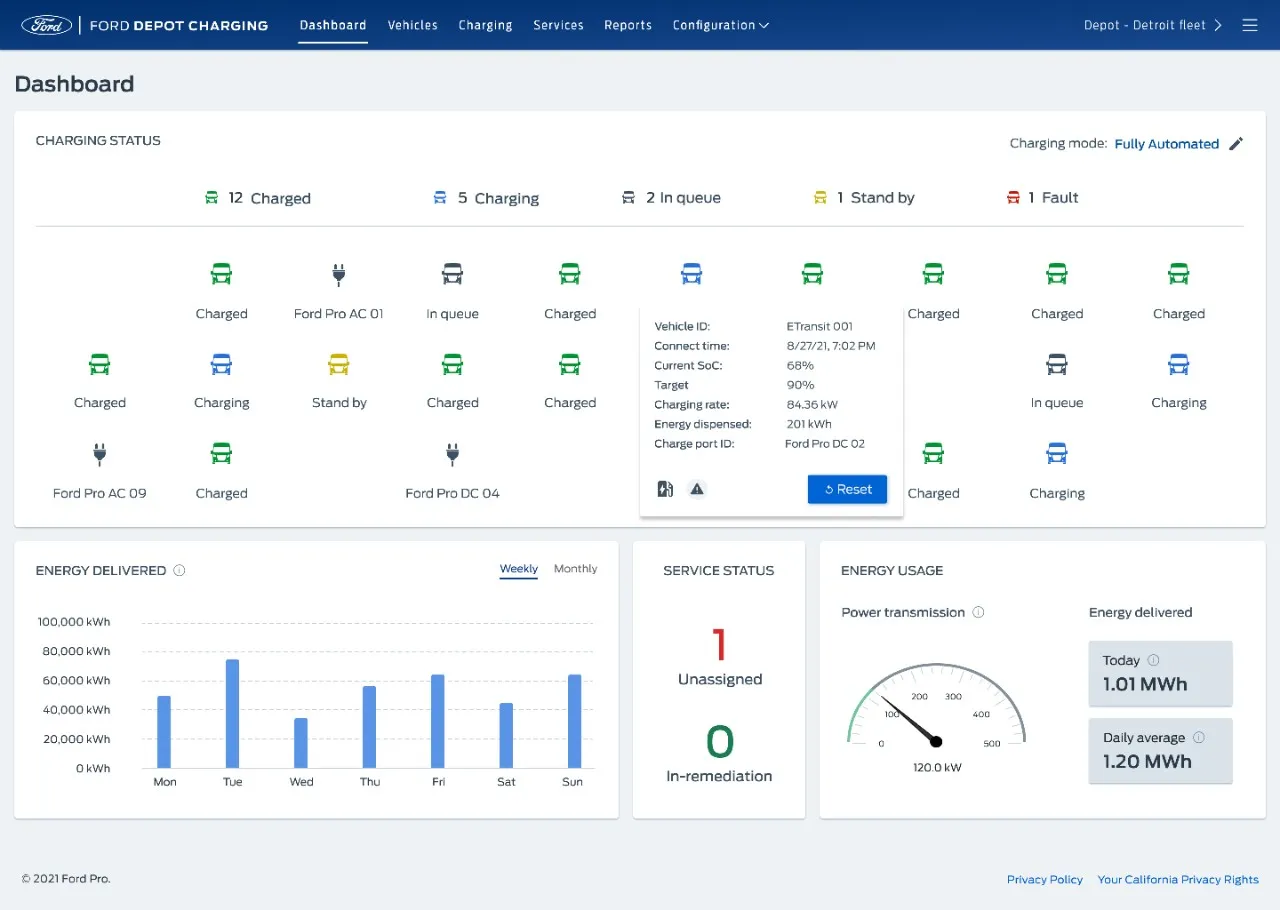

Ford’s growth in the commercial sector is partly attributed to advancements in software technology tailored for its commercial clients, who tend to adopt new technologies and digital services more quickly than traditional consumers. In fact, Ford Pro saw a remarkable 35% increase in software subscriptions during the second quarter, and mobile repair orders completed by the company’s fleet more than doubled.

The Role of Software in Future Growth

As Ford dives deeper into digital services, the automotive industry is poised for a transformation that could significantly enhance profit margins. According to Andreas Nienhaus from Oliver Wyman Forum, “The economies of scale are enormous for automakers with digital services.” As more customers engage with these services, automakers can collect more data and refine their offerings without the need for extensive additional hardware, as much of it is already integrated into the vehicle.

The potential for growth in the automotive digital service market is staggering. A recent report predicts that the global market for advanced driver-assistance systems could reach $307 billion by 2035, a massive leap from just $1.7 billion in 2023. Additionally, revenues from digital automotive services are expected to grow at an annual rate of 25%, skyrocketing from $42 billion in 2023 to an astonishing $610 billion by 2035. This includes various services such as car-as-a-service, micro-mobility solutions, and air mobility.

Implications for Investors

For long-term investors in the automotive sector, the shift towards digital services could represent a significant margin expansion opportunity. If Ford’s digital offerings have a similar positive impact on Ford Blue as they have on Ford Pro, it could signal a new era of profitability in the automotive industry. Investors may soon witness margins that far exceed the historically low levels seen in traditional automotive manufacturing.

This positive outlook comes as a relief to Ford investors who have faced a decade of declining share prices, with Ford’s stock dropping 18% compared to the S&P 500’s impressive 197% gain over the same period. With the digital landscape evolving rapidly, the future for automakers like Ford appears much more promising, setting the stage for enhanced competitiveness and profitability in the years to come.

Ford’s strategic investments in digital and software services could be the catalyst for a transformational shift in the automotive industry, ultimately redefining how companies approach their business models and interact with consumers.